Some second-tier hospitals are expanding to the second-tier market to unlock value.

Asia's major hospital chains face growing competition for more affordable healthcare providers for middle-income families, with a projected number of nearly 800 million by 2030.

Emerging hotspots like India, Singapore and Vietnam are the first to lead healthcare growth, driven by demographic changes, geopolitical headwinds, wealth and massive investment, according to the Boston Consulting Group.

For example, a general hospital in Vietnam started in 2012 and operated four hospitals across the country, expanding to the second-tier markets in the Mekong Delta and the Central Highlands, rather than focusing only on metropolitan and 1st-tier city months.

The consulting firm said Asia's health care sector is a fertile ground for companies seeking to unlock value and bridge key gaps in access and infrastructure. It added that the region's healthcare market is expected to reach $5 trillion in five years and will contribute 40% to global healthcare growth.

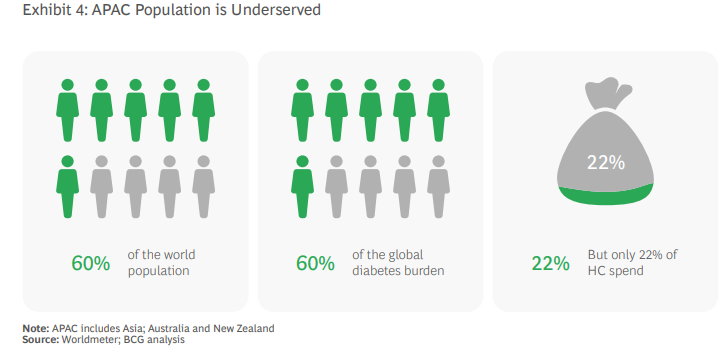

It noted: “Although it accounts for 60% of the world's population, Asia accounts for only 22% of global health care spending, and chronic diseases such as diabetes and cancer can affect the region.”

The consulting firm said mid-term healthcare providers are expanding into developing markets, not just the elite serving as medical expenses rise. In countries such as India, Vietnam and Thailand, private health care remains expensive despite increased government funding.

It noted: “Most of the expenses (38% to 48%) are still paid out of your pocket.”

Middle-income households in Asia are expected to increase from US$181 million in 2000 to 756 million by 2030.

Another report from management consulting and technology firm ZS Associates shows that consumers are willing to accept alternative care models if they can afford it and facilitate it.

“Most consumers in our survey said they are willing to receive many forms of care from people other than doctors,” it said. “This includes interactions, such as prescription supplements and recommendation requests, as well as more personal and high hormones , such as annual examinations and chronic disease management. ”

Boston Consulting said some providers (such as the Kidney Dialysis Center in India), chains specializing in kidney care, focus on high demand specialties and price processing volumes of around $25, 40% less than the large hospitals in India.

This trend is evident in Singapore, where outpatient care speeds up procedures in an overwhelming medical system.

Meanwhile, the Indian government announced that all regional hospitals will be dedicated to dated cancer centres within the next three years. “We're seeing the advent of professional models for healthcare delivery that create focused business models with higher efficiency and lower costs,” the consulting firm added.

Ask questions:

How do senior hospital chains compete with intermediate healthcare providers?

With the expansion of intermediate providers, how does the healthcare sector look in Asia by 2030?