Chinese leaders say they are ready to stimulate the economy next year to counter the impact of trade tariffs expected to be imposed when Donald Trump takes office next month.

Officials said after Monday's Politburo meeting that they would adopt a “moderately loose” monetary policy stance and “more proactive” fiscal leverage.

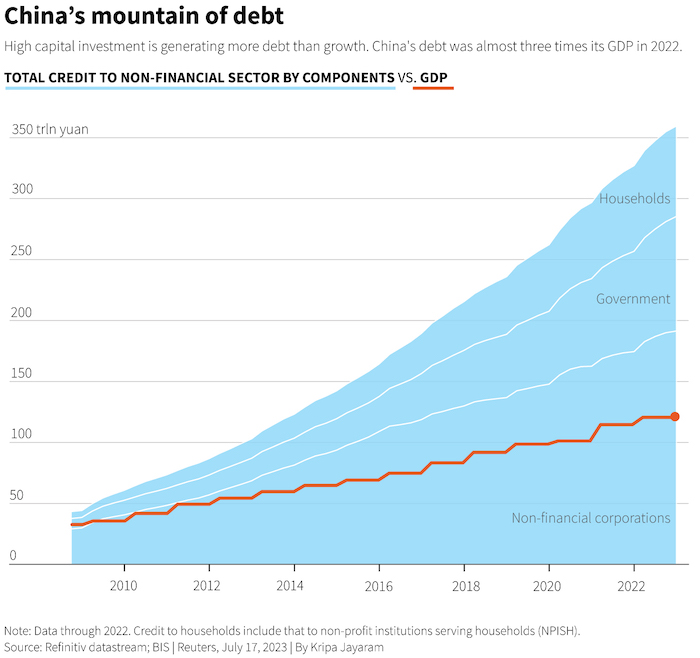

The People's Bank of China has adopted a “prudent” stance over the past 14 years, while at the same time overall debt, including government, household and corporate debt, has increased more than fivefold. Gross domestic product (GDP) roughly tripled during the same period.

See also: China launches antitrust probe, Nvidia 'faces $1 billion fine'

The Politburo rarely details its policy plans, but the shift in its message suggests China is willing to deepen its debt further and prioritize growth over financial risks, at least in the short term.

Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered Bank, said, “It is a big change from stability to moderate easing.” “This leaves a lot of room for imagination.”

China Economic Indicators China Debt vs GDP

Tang Yao, an associate professor of applied economics at Peking University, said such policy adjustments are necessary because slower growth will make it harder to repay debt.

“Generally speaking, they have accepted that the debt-to-GDP ratio is going to rise further,” said Christopher Beddor, associate director of China research at Longtime News, adding that it was no longer “a binding problem”. constraint. “

It's unclear how much monetary easing the central bank can implement next year and how much debt the Treasury can issue. But analysts say this is good for Beijing.

U.S. President-elect Donald Trump returned to the White House in January after vowing during his campaign to impose tariffs of more than 60% on U.S. imports of Chinese goods.

China has stated through official media that Oppose trade war, But Trump and his choice of trade advisers suggest he is likely to deliver on his campaign promises.

A Reuters poll last month showed the timing and final level of the tax Initially expected to be close to 40%will determine Beijing’s response.

Budget deficit could reach 4%

“They are willing to do 'whatever it takes' to achieve their GDP target,” said Larry Hu, chief China economist at Macquarie.

“But they will do it in a passive way,” Hu said. “How much they can do by 2025 depends on two things: their GDP target and new U.S. tariffs.”

Growth, budget deficit and other targets for next year 2025 will be discussed in the coming days at the annual meeting of Communist Party leaders, known as the Central Economic Work Conference (CEWC), but will not be announced.

Reuters reported last month that most government advisers recommended that Beijing should maintain its growth target of about 5%, although that pace appears to be difficult to achieve throughout this year.

Zong Liang, chief researcher at state-owned Bank of China, said the tone of the Politburo statement showed China would not lower its 2025 growth target. But it also shows that China may set its initial budget deficit target at around 4%, the highest level in history.

Lu Ting, chief China economist at Nomura Securities, said, “Beijing may want to use a growth target of 'around 5.0%' to show that it will not give in to Trump's threat to impose 60% tariffs and other restrictive measures on China.” Fiscal The deficit will rise to 4% from 3% in 2024.

A one percentage point increase in the deficit would be equivalent to about 1.3 trillion yuan ($179.4 billion) in additional stimulus, but if needed, China could increase stimulus by issuing off-budget special bonds or allowing local governments to do so.

With local government debt too high, Beijing is expected to gradually assume greater fiscal responsibility.

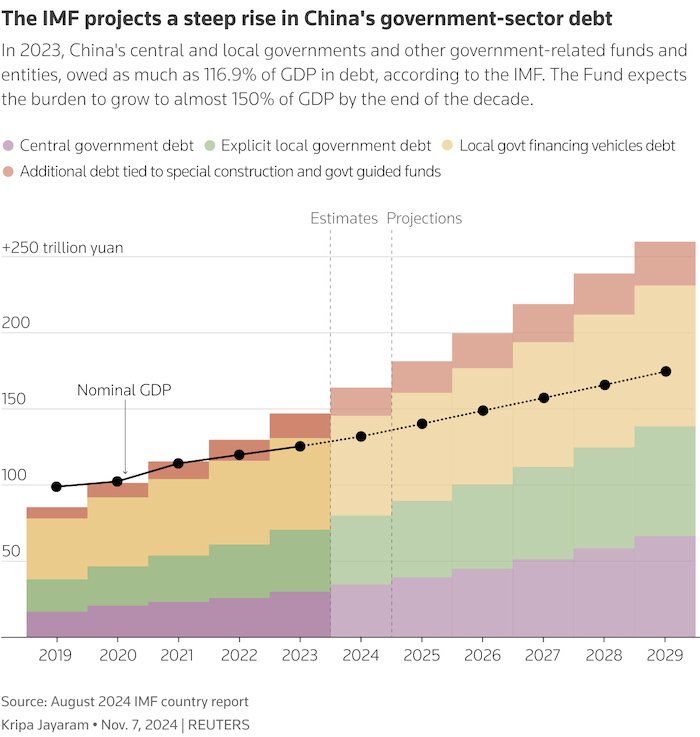

The International Monetary Fund expects China's government sector debt to rise sharply.

“Unconventional adjustments” are expected to boost consumption

China is facing strong deflationary pressures as consumers feel their wealth has dwindled due to a long-term real estate crisis and extremely low social welfare. Low household demand is a major risk to growth.

The Politburo is clearly responding to this risk, promising “unconventional countercyclical adjustments” and “a major boost to consumption.”

Goldman Sachs analysts said in a note that the new language suggests the composition of the stimulus “may be significantly different from past cycles, focusing more on consumption, high-tech manufacturing and risk containment rather than traditional infrastructure and real estate.” invest”.

Morgan Stanley also interpreted the statement as suggesting that increasing consumption will be the “top priority in 2025,” but warned that “implementation remains uncertain.”

China has made increasingly forceful statements about stimulating consumption throughout the year but has offered few policies beyond subsidy programs for purchases of cars, home appliances and some other goods.

It is still unknown what measures Beijing is prepared to take to stimulate consumption. But in an economy that has been centered on production for decades, demand-focused measures are key to improving the effectiveness of monetary policy easing.

“China's monetary easing is far less effective than it once was,” said Julian Evans-Pritchard, an analyst at Capital Economics.

“Right now, households and much of the private sector have limited appetite to take on more debt, even with lower interest rates.”

- Reuters Additional input and editing by Jim Pollard

See also:

Chinese media on Trump: “There are no winners in the tariff war”

Trump outlines plan to impose new tariffs on Canada, Mexico and China

Economists say Trump will not impose 60% tariffs on China as soon as possible

Chinese ship suspected of cutting undersea cable in Baltic Sea

IMF warns retaliatory trade tariffs could backfire in Asia

Trump's plan to eliminate electric vehicle tax credits 'could benefit China'

Trump will have major impact on trade, climate change, electric vehicles

Trump says he will impose high tariffs on China if it occupies Taiwan

Elon Musk's U-turn: U.S. Tariffs on Chinese Electric Vehicles “Not Bad”

Trump claims poll victory, China faces more trade competition